Planning a trip abroad always starts with the fun bits, flights, hotels, things to do. Then you hit the question that feels boring but really matters, what is the best card to use abroad so you are not stung by fees or left without money when you need it.

Most travellers reach for whatever card is already in their wallet, a normal debit card or a credit card. The problem is that many standard bank cards add a foreign transaction fee on top of the exchange rate, often around3%, and can charge even more when you withdraw cash. That is before you run into dynamic currency conversion, where choosing to “pay in pounds” can quietly cost you extra.

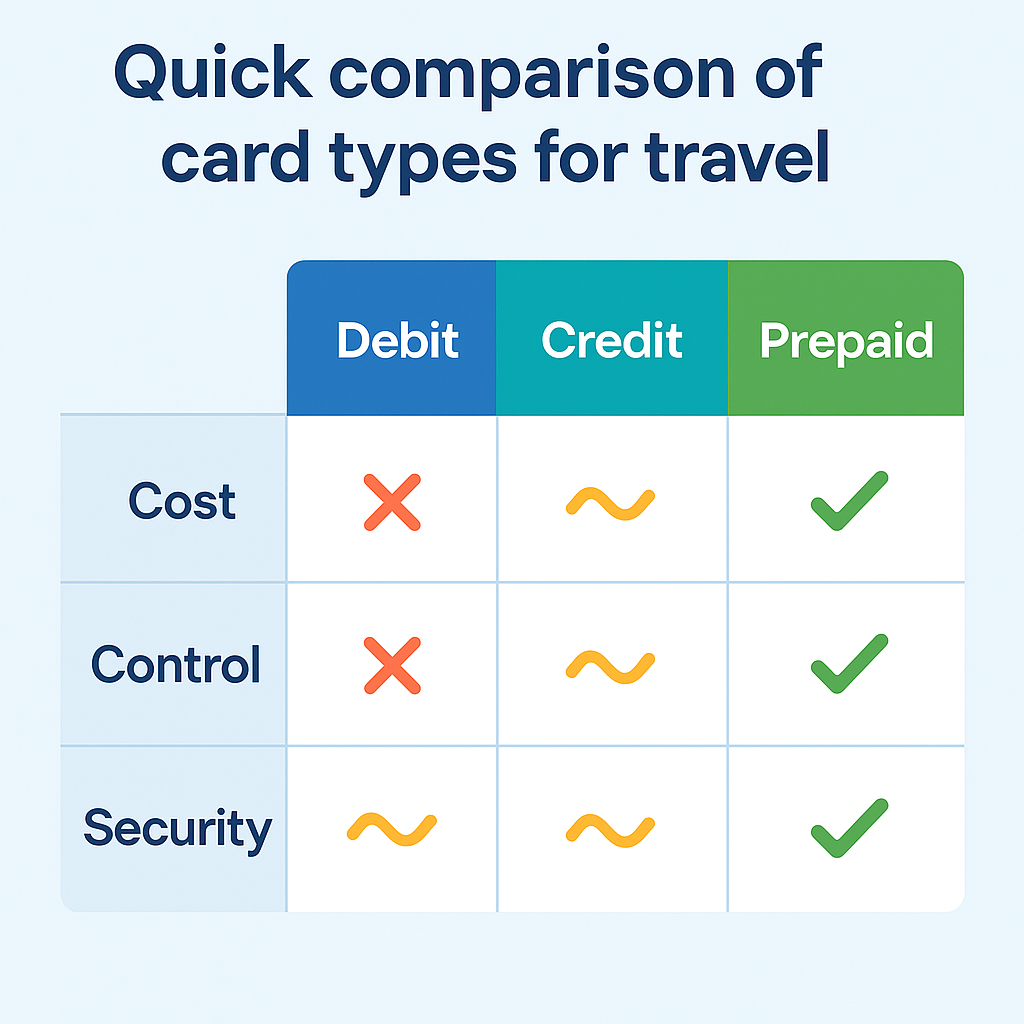

In this guide, we look at all the main options, debit, credit and prepaid, then show why a well chosen prepaid travel card is often the best card to use abroad for UK holidaymakers, especially when you want control, safety and clarity over your holiday money.

What people really mean by best card to use abroad

When someone types best card to use abroad into a search box, they are not asking for a technical breakdown of payment schemes. They are really asking, which card will keep my trip simple and affordable.

Usually they want a mix of four things.

- Low or transparent fees when spending and withdrawing abroad

- A card that is widely accepted in shops, restaurants and online

- Protection if something goes wrong, from fraud to card loss

- A way to avoid overspending or dipping into money that is meant for bills at home

There are three main card types that can do this job.

- Debit cards linked directly to your current account

- Credit cards that may offer rewards or fee free spending but can charge interest on cash withdrawals

- Prepaid travel cards, which you load in advance and use for card payments and cash withdrawals

Cash still has a role, but most people now want to handle the majority of spending by card. Once you look at the details, prepaid travel cards often line up best with the “holiday money” job for many travellers.

Quick overview of the main card types

A standard debit card is convenient but many banks add a non sterling transaction fee on top of the exchange rate for every purchase and withdrawal. A travel credit card can be good for fee free spending, but if you withdraw cash you can pay interest from day one, and not everyone will qualify for the best products.

A prepaid travel card sits in the middle. You top it up from your bank account, sometimes in pounds, sometimes directly in foreign currency, then spend from that balance. It is not tied to your main current account, which helps with safety and budgeting.

How card fees work when you spend abroad

To understand why card choice matters, you need a simple view of how card fees work.

When you use a card abroad, two big things decide what you pay.

- The exchange rate used to convert your pounds to the local currency

- Any extra fees charged by your bank or card provider on top

Many high street debit cards add a non sterling transaction fee of around 2.75 to 2.99 percent on every purchase or withdrawal in a foreign currency. If you spend the equivalent of £500 on your holiday, you can lose around £15 just in these percentage fees, before you even consider ATM charges.

Credit cards can be similar, and if you use them to take out cash you may also pay a separate cash fee plus interest from the day of the withdrawal.

Foreign exchange rates and markups

Behind the scenes, card schemes like Visa and Mastercard publish a base exchange rate each day. Specialist travel cards and some prepaid travel cards pass that rate on with little or no markup. Many mainstream banks add their own margin on top, often close to three percent.

The upshot is that two people can buy the same €100 meal abroad, but the person using a typical bank debit card might see several pounds more leave their account than the person using a well chosen travel focused card.

ATM and cash withdrawal charges

Cash is still useful abroad, whether it is for markets, tipping or small purchases. However, cash withdrawals are often where the worst costs hide.

- Many credit cards charge a cash advance fee, plus interest that starts immediately.

- Some debit cards add both a percentage fee and a minimum cash fee to every withdrawal.

- Local ATMs can also charge their own fee, shown on screen before you confirm.

If you only need a bit of cash, these layers of fees can make every withdrawal surprisingly expensive.

The DCC trap, paying in pounds versus local currency

On top of all this sits dynamic currency conversion. At tills and ATMs you are often asked whether you want to pay in pounds or in the local currency. It feels natural to choose pounds, you recognise the number. In reality, this usually means the local bank or merchant chooses a poor exchange rate for you.

As a rule of thumb, if you want to keep costs down, always choose to pay in the local currency and let your card provider handle the conversion.

Why prepaid travel cards fit the holiday money job best

Once you understand the mechanics of fees, the case for prepaid travel cards becomes much clearer.

A prepaid travel card is not magic, it still has fees. The difference is that you can see them up front and you can choose a card that fits how you plan to travel. For many holidaymakers, that makes a prepaid travel card the best card to use abroad.

Security and separation from your main account

With a prepaid card you only put the money you are comfortable spending on the trip. If the card is skimmed, cloned or lost, the exposure is limited to the holiday balance, not your rent and bills sitting in your current account.

Because the card is separate from your main account, you can freeze it in the app if something looks wrong, adjust limits or move funds off the card if needed. Many travellers like this psychological separation, your everyday account stays untouched while your prepaid balance is purely for the trip.

Budgeting and spend control on holiday

Prepaid travel cards were built with budgeting in mind. You load a fixed amount, see that balance in the app, and watch it go down as you spend. For many people this simple visual cue is more powerful than tracking card transactions across multiple accounts.

You can top up mid trip if needed, but the default is control. That makes prepaid travel cards particularly attractive if you know you tend to overspend when everything goes on one credit card that you only face at the end of the month.

Prepaid travel cards were built with budgeting in mind. You load a fixed amount, see that balance in the app, and watch it go down as you spend. For many people this simple visual cue is more powerful than tracking card transactions across multiple accounts.

You can top up mid trip if needed, but the default is control. That makes prepaid travel cards particularly attractive if you know you tend to overspend when everything goes on one credit card that you only face at the end of the month.

Transparency and predictability of fees

Because prepaid travel cards compete head to head, providers lay out their fees in more detail. You can see:

- FX margin or rate model

- ATM withdrawal charges, both in the UK and abroad

- Any inactivity or monthly fees

- Top up fees for certain methods

A site like ptc. exists to pull this information together across the market, so you can compare prepaid travel cards side by side instead of reading small print from scratch for every brand. That transparency is a big part of why prepaid travel cards fit the holiday money job so well.

How to choose the best prepaid travel card for your trip

Deciding that a prepaid travel card is the best card to use abroad is only half the story. You still need to pick the right one for you.

A good way to do this is to work through a few simple steps.

Step 1: Define your destination and main currency

If you are mainly travelling within the eurozone, your ideal card might be different to someone going to the United States or hopping between several countries on one trip. Some prepaid cards support a wide range of currencies, others focus on a smaller set.

Think about your next twelve months. If you might be visiting Europe and North America, a multi currency card could be more useful than a euro only card.

Step 2: Decide if you are mostly spending by card or withdrawing cash

If you plan to pay by card most of the time, look for a prepaid card with low or zero FX fees on purchases. If you expect to rely more on cash, pay close attention to ATM charges abroad and any caps or fair use limits.

Step 3: Compare fees, FX and ATM charges side by side

This is where independent prepaid travel card reviews and comparison tables help. ptc. specialises in breaking down:

- FX margin or rate model

- Purchase fees

- ATM withdrawal fees

- Top up costs

- Monthly or inactivity fees

Looking at the headline “fee free” claim is not enough. The details decide whether the card is genuinely competitive for your type of trip.

Step 4: Check app features, support and controls

In practice, you will manage your card through an app. Look for features like:

- Instant card freeze and unfreeze

- Real time spend notifications

- Easy top ups from your UK bank

- In app support or live chat

Human support matters if something goes wrong when you are abroad.

Step 5: Shortlist and apply through trusted providers

Once you have narrowed things down, apply through the official provider or a trusted comparison partner. A site like ptc. can direct you from its prepaid travel cards hub to the right providers for your chosen card.

Prepaid travel cards for under 18s and family trips

One area where prepaid travel cards really stand out is family travel and trips involving teenagers.

Credit cards are off the table for under 18s, and even debit card options can be limited. A prepaid travel money card for under 18 can give older children a safe way to pay abroad, with spending limits and controls you set as the adult.

Under 18 eligibility and controls

Many youth oriented prepaid cards allow parents or guardians to:

- Load funds onto a child card

- Set spending limits by day, week or trip

- Turn certain merchant categories on or off

- See transaction history in their own app view

For school trips, sports tours or gap year travel, this combination of independence and oversight can be very useful.

Practical examples, school trips and family holidays

On a school trip, a teenager can pay for lunches and small treats with the card, without carrying large amounts of cash. You can top up from home if needed. On a family holiday, you might have separate cards for you and your partner plus one for an older child, all drawing from the same holiday budget.

ptc. signposts dedicated content for kids and teens, you can explore options via pages like “Kids Prepaid Travel Cards” to see which prepaid travel cards are suitable for under 18s and how they are structured.

Real world holiday scenarios, which card works best

Seeing how this plays out in real life helps.

City break example

Imagine a three night city break in Europe. Most spend is on contactless card payments in shops, restaurants and attractions, with maybe one small cash withdrawal.

A standard debit card that adds almost three percent to every transaction could quietly add a noticeable cost to your weekend. A prepaid travel card with a competitive FX rate and low or no fees on card payments will normally work out cheaper, while still giving you real time app visibility of your spend.

Family resort holiday example

Now think about a two week family holiday at a resort. You are paying for meals, excursions, taxis and occasional cash withdrawals. You may also want a separate card for a teenager.

Here, a prepaid travel card can help you ring fence your holiday budget, spread funds across multiple cards if needed, and avoid mixing holiday spend with household direct debits and bills. You can still bring a fee free debit or credit card as a backup, but the prepaid travel card handles most day to day spend.

Multi country trip example

For a multi country trip, especially outside the eurozone, a multi currency prepaid card can simplify things. You may be able to hold balances in different currencies or at least rely on a mid market FX model that is more transparent than standard bank cards.

In each of these scenarios, a well chosen prepaid travel card looks like the best card to use abroad for the main part of your spending, with other cards playing a supporting role.

Practical travel money tips when using cards abroad

Whatever card you choose, a few simple rules will make your holiday money go further.

- Always pay in the local currency at tills and ATMs, not in pounds.

- Keep a backup card in a separate place in case your main card is lost or stolen.

- Set up app alerts so you see transactions in real time.

- Check your card limits before you travel and adjust if needed.

- Carry a small amount of local cash for emergencies and places that do not accept cards.

These habits pair well with prepaid travel cards and help you avoid the most common money mistakes abroad.

How ptc. helps you find the best card to use abroad

ptc. is a UK based comparison site focused on prepaid cards and travel money cards. Instead of pushing one product, it brings together detailed information on fees, FX, ATM charges, limits and features across a wide range of prepaid travel cards.

If you want to go deeper after reading this guide, you can:

- Explore the main prepaid travel cards hub page to see a curated list of travel focused prepaid options.

- Read individual prepaid travel card reviews that break down fees, FX and app experience in more detail.

- Visit specialist sections such as prepaid travel money card for under 18 to see options that support family and youth travel.

By using independent reviews and comparisons rather than just marketing promises, you give yourself the best chance of picking a prepaid travel card that genuinely matches how you travel.

Frequently Asked Questions about the best card to use abroad

Do prepaid travel cards have hidden fees I should worry about?

Some prepaid cards charge inactivity fees, ATM fees or certain top up fees, so it is important to check the details. The advantage is that these fees are usually spelled out in one place, and independent prepaid travel card reviews make them easier to compare. If you take a few minutes to read those reviews, you can avoid cards with charges that do not fit how you plan to use the card.

Can I get a prepaid travel money card for my child under 18?

There are prepaid travel cards designed for teenagers and family use. They can give your child a safe way to pay on school trips or family holidays, with controls and oversight for you as the parent. You should always check age limits, ID requirements and card controls carefully. ptc. has dedicated content on kids and under 18s to help you understand the options.

What if my prepaid travel card is lost or stolen abroad?

Most prepaid travel cards come with an app that lets you freeze the card instantly and contact support for a replacement. Because the card is not tied to your main current account, the potential damage is limited to the balance on the card. It is still wise to keep a backup card and some cash separate, so you have options while you wait for a replacement if needed.