Gen Z consumers are now shaping the British payments landscape. In 2025, this cohort demonstrates more cautious spending tendencies, a strong preference for digital control, and a hunger for transparent financial tools. Prepaid cards and mobile-first payment options align with this demand for control and clarity.

This article analyses the latest trends, explains why Gen Z prefers non-credit options, and outlines how ptc. interprets these changes for consumers and the payments industry.

What the 2025 data shows

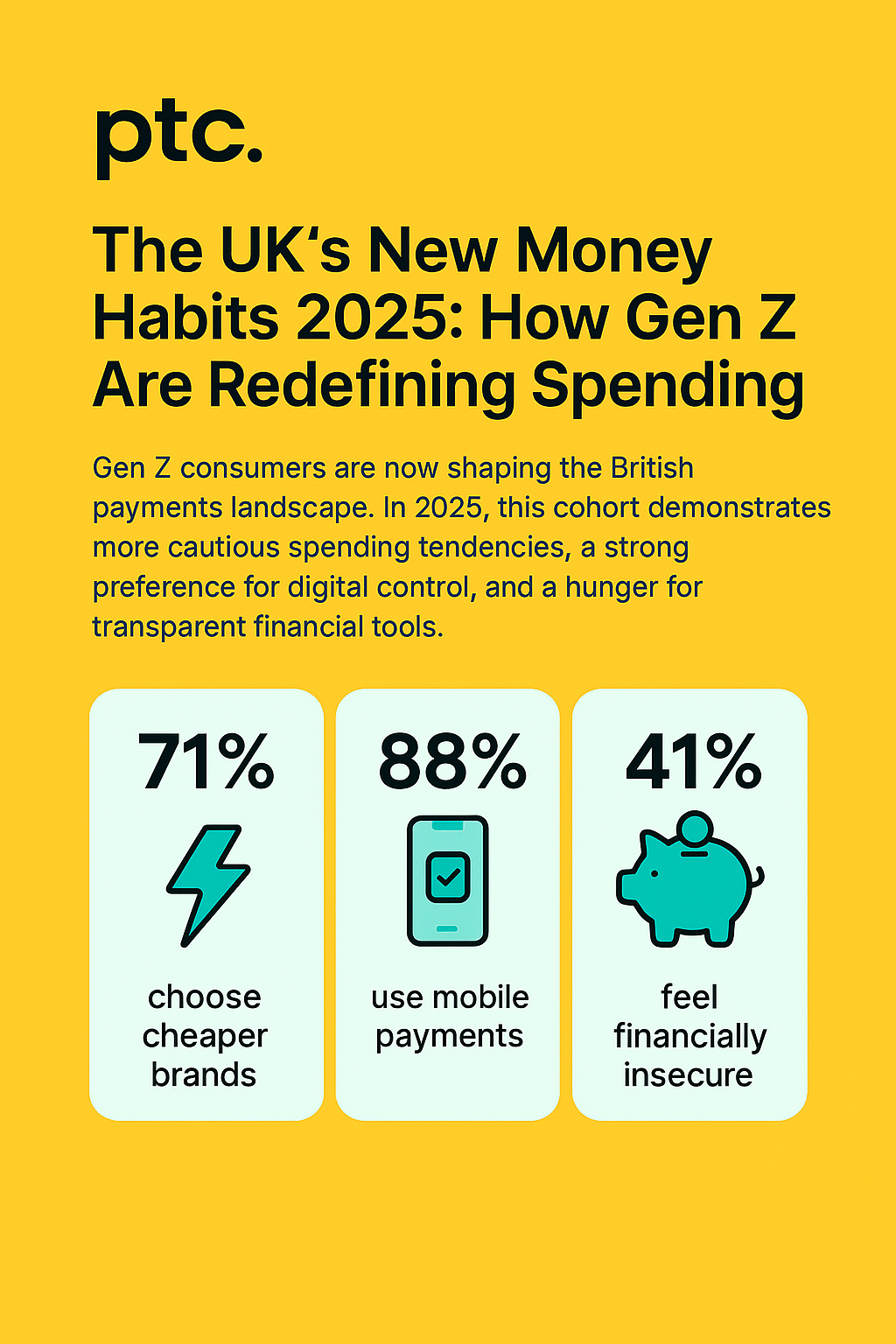

According to the UK Consumer Trends report by Attest (2025), Gen Z consumers were the least likely to describe themselves as financially secure (41 %), and 71 % said they would choose a cheaper brand over their favourite currently.

Further, the UK Finance Payment Markets report shows that 88 % of 16-24-year-olds were registered to use mobile payments, illustrating the mobile-first mindset of younger consumers.

Why Gen Z prefers prepaid and digital-first options

- Control over spending: Gen Z wants predictable outcomes and minimal surprises. A prepaid card gives a fixed limit, reducing the risk of debt.

- Digital-native experience: Instant top-ups, real-time transaction alerts, and app-based management suit younger users.

- Avoidance of debt: Many younger consumers see credit as risky or undesirable. Prepaid offers the convenience of a card without borrowing.

- Financial education and visibility: Prepaid cards allow younger consumers to monitor spending and build budgeting habits in a low-risk environment.

How brands can respond

Brands and fintechs targeting Gen Z should prioritise:

- Transparent fee structures and easy-to-understand terms.

- App-first onboarding and payment features.

- Educational tools or companion features to support budgeting.

- Features that align with Gen Z values (e.g., sustainability, social responsibility) while still offering affordability and control.

Expert opinion

“Gen Z wants financial tools that reflect how they live” says Aashish Sharma of ptc.. “They demand control, clarity, and mobile-first convenience. Prepaid cards offer exactly that; they are predictable, digital-native, and align with a generation that values independence without unnecessary risk.”

Product features that matter to Gen Z

Recent data and market reporting in 2025 reveal features Gen Z prioritise:

- Real-time notifications of each transaction.

- Instant peer transfers and top-ups.

- Goal-based saving buckets within the app.

- Transparent international or foreign-currency fees.

These features often appear in prepaid card apps built for modern budgets rather than traditional banking.

What this means for the UK payments market

The payments market in 2025 is becoming increasingly bifurcated. Traditional banks continue to serve mainstream needs, while digital-first, transparent payment services capture younger and budget-conscious segments. Prepaid cards and mobile wallets are emerging as the bridge between cash and credit for younger users.

Final takeaway

Gen Z is not abandoning spending. The cohort is reshaping how spending is organised. They prefer control, transparency, and digital tools. For brands and product teams that want to build long-term loyalty, offering prepaid and digitally native payment choices is now non-negotiable.