Every year, travellers face two recurring issues. One is losing cash or cards while abroad. The other is paying more than they should because of fees and poor exchange rates. In 2025, travellers had better, safer options than ever. Prepaid travel cards and secure mobile wallet features made cross-border spending simpler and reduced financial risk.

This guide explains when a prepaid travel card makes sense, the safety advantages it offers, and practical steps that holiday-makers can follow to protect their money while travelling.

Why travellers are shifting to prepaid solutions

Recent reports show that the UK’s reliance on physical cash has fallen to an all-time low. According to a report by The Standard, just under 10% of payments in the UK were made using cash, while over 57% of adults are now registered to use mobile wallets such as Apple Pay and Google Pay.

For travellers, this shift isn’t just about convenience; it’s about safety. With digital money, the risk of theft, card skimming, or losing physical currency is significantly reduced.

The top safety benefits of prepaid cards

- Limited exposure to fraud: Prepaid cards are not directly linked to your main bank balance. If a prepaid card is lost or misused, the financial loss is capped at the loaded amount.

- Better monitoring and control: Prepaid cards and their associated apps often provide real-time balance updates and transaction alerts. This visibility helps travellers spot suspicious charges quickly.

- Locked exchange rates: Loading currency in advance protects travellers from unexpected FX fluctuations during the trip.

- Fewer surprise bills: Most prepaid travel cards clearly display fees (e.g., loading, ATM withdrawal, foreign transactions), making it easier to forecast holiday spending.

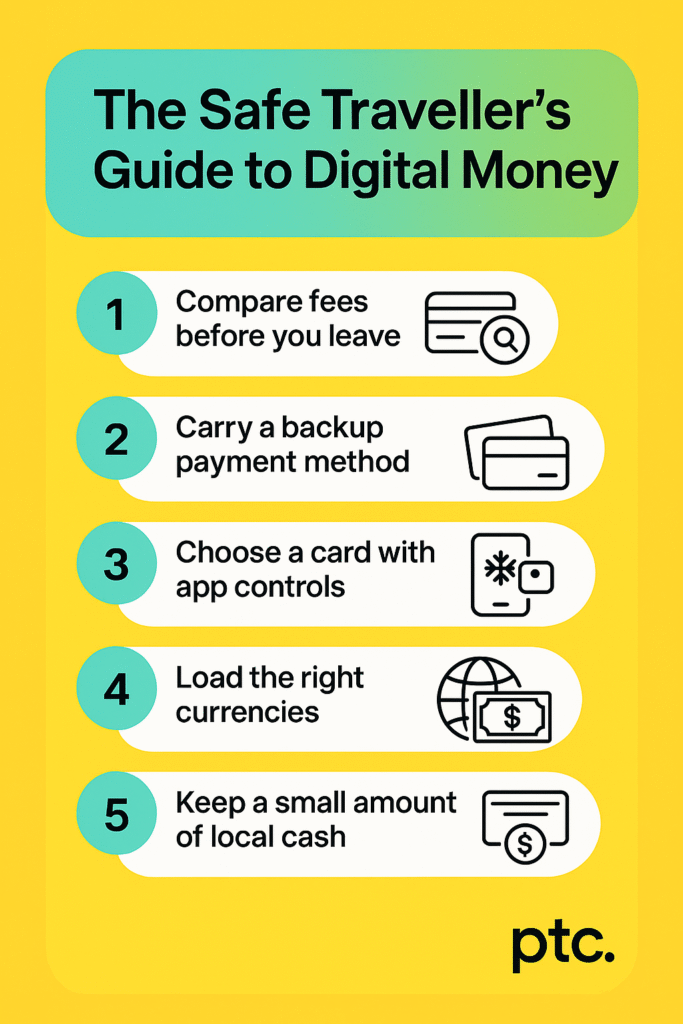

Practical steps for safe travel-money management

- Compare fees before you leave: Use trusted guides to check both card spending fees and ATM withdrawal fees.

- Carry a backup payment method: In addition to a prepaid travel card, carry one bank debit or credit card stored separately.

- Choose a card with app controls: Freeze/unfreeze from your phone, monitor spend, set alerts.

- Load the right currencies: If you plan to visit multiple countries, load a multi-currency prepaid card or top up local currency when you arrive based on rates.

- Keep a small amount of local cash: Digital payments are strong, but cash can still be useful in remote areas or markets.

Fraud and security tips

Always enable two-factor authentication on your prepaid card’s app when available. Check transaction alerts regularly and reconcile small purchases daily, especially on long trips. If you suspect ATM skimming or card fraud, block the card immediately and report it to the issuer.

Expert opinion

“Prepaid cards are a straightforward risk-management tool for travellers,” says Aashish Sharma, Strategy Consultant at ptc.. “They reduce exposure to fraud, limit overspending and remove many of the common financial headaches people face on holiday.”

Final checklist

Before you travel during the holiday season in 2025: